If you have clients ages 55-65 who are self-employed (at least one person for a married couple) and plan to work for 5-10 more years, use this powerful federal tax deduction in conjunction with purchasing a hybrid long-term care policy.

Hybrid Long-Term Care Policy Essentials

Built on a life or annuity chassis, these policies allow for access to the death benefit/policy values/LTC extension pool in the case of a long-term care need. Here are the essentials for using the right policy to make this strategy work best:

- Must be a 7702b based plan. Only policies/riders registered as a 7702b can call themselves long term care. They also require a health license and training for the 7702b aspects. Comparatively, many plans in today’s market are 101g plans and are not appropriate for this strategy.

- The premiums are guaranteed

- A death benefit is paid if not used for long-term care

- A residual death benefit is paid if the policy is exhausted

- The policy death benefit can be increased or extended beyond the initial period to provide additional long-term care benefits

- Optional inflation rider

- Ideally, the policy pays indemnity (cash) benefits

- Must have separately identifiable policy components and premiums (base vs. LTC)

The first and last items (7702b/separately identifiable components) are the most important to be able to take this federal deduction.

Policy Example

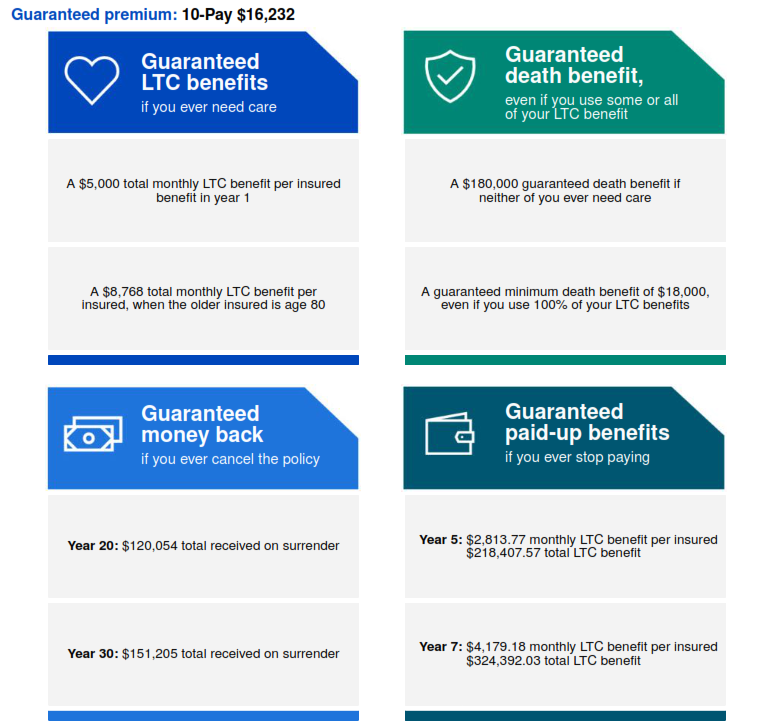

Meet Harry and Sally. They are a healthy 61yo married couple (where at least one person-Sally-receives self-employment income via 1099) who are looking for long-term care coverage AND simultaneous tax deductions. They are currently considering this plan below, which is structured for them to pay premiums from ages 61-70 (10 pay).

To view the complete illustration with all disclosures where this screenshot was generated from, CLICK HERE

The Tax Deduction

This article is primarily for pass through entities (S corp, sole proprietors, and partnerships). However, C corps are also eligible for even more substantial deductions. You can read about how that works HERE.

Typically, LTC premiums are deductible if medical expenses exceed the 7.5% threshold of AGI as an itemized deduction. Even this deduction is subject to some limitations.

HOWEVER, self-employed individuals purchasing long-term care insurance are allowed to deduct 100% of their out of pocket long-term care premiums, up to the federal tax deductible limit, WITHOUT meeting this threshold. Even though the policies are individually owned, who pays the premium (business or individual) depends on the tax structure of the business. Please discuss this with your clients’ accountant about where the premiums should come from to take advantage of this deduction.

There are four main steps to take to determine the deduction:

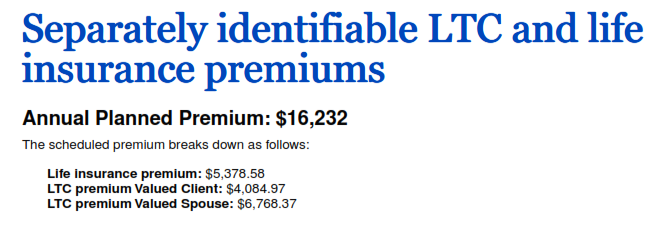

First, review the illustration to understand what part of the premiums are going towards the death benefit and what part are going toward the LTC portion. The illustration should have a page that highlights this. The breakdown below is from our example case, Harry and Sally:

In this example, Harry is “Valued Client” and Sally is “Valued Spouse”

Next, review the age based limits for the current tax year:

| Attained Age before end of taxable Year | 2023 Limit | 2024 Limit | 2025 Limit |

| 40 or under | $480 | $470 | $480 |

| 41-50 | $890 | $880 | $900 |

| 51-60 | $1,790 | $1,760 | $1,800 |

| 61-70 | $4,770 | $4,710 | $4,810 |

| 71 and older | $5,960 | $5,880 | $6,020 |

Then, determine the lesser amount (premium vs. federal limit) for EACH insured. Even if only Sally is self-employed, the deduction can be taken for both her and Harry. Add the deductions together for the total deduction.

Finally, those eligible for a self-employed health deduction may deduct the result above-the-line on schedule 1 of IRS form 1040. Please discuss this with your accountant.

The Result

Harry has an LTC premium of $4,084.97 and an allowable deduction of $4,810.00 so he takes the lesser amount ($4,084.97).

Sally has an LTC premium of $6,768.37 and an allowable deduction of $4,810.00 so she takes the lesser amount ($4,810.00).

Combined, Harry and Sally could take an annual deduction of $8,894.97 (more than half of the total premium for the policy) subject to Sally’s continued self-employment income and the current annual limits set forth by the IRS.

In addition, after depositing $162,319 over 10 years, at age 81 (policy year 20) they have a guaranteed pool of LTC benefits totaling $650,200 (more than 4x their total premiums) and if that goes unused, a death benefit of 180k (both of which should be tax-free when utilized).

In conjunction with the advice of you (their advisor) and their accountant, purchasing a long term care policy while self employed can yield some great benefits, both on their tax return and for their overall asset protection strategy.

If you have a client that you think can benefit from this strategy, reach out to us HERE and we’ll help you design a plan.

Disclaimer: We do not offer tax or legal advice and this post should not be construed as such. You are encouraged to discuss these concepts with your accountant or attorney.