In our last two articles, we discussed utilizing alternatives to multi-year guaranteed annuities using non-qualified assets. Those assets, not being utilized for retirement and ultimately passing on to the next generation may be better suited in a hybrid annuity product or a single-pay life product.

Given that the US retirement market is largely composed of qualified money, it is essential to have solutions that address that segment as well.

Client Profile

AGE: Typically, 55-70

SITUATION: A client in their peak earning years, or recently retired, inherits an IRA that must be distributed, even though the assets are not needed for retirement.

TYPE: Inherited IRA

OBJECTIVE: Utilize the windfall to protect the assets needed in retirement and minimize tax liability.

The Lowdown

This article will address post 2020 inherited IRAs, where the non-spouse (or non-eligible designated beneficiary) in most cases needs to withdraw the entire IRA by year 10 AND take annual RMDs if the owner died after RMD age.

Inheriting an IRA can be a windfall for some baby boomers and Generation X nearing or already in retirement.

For others, it is income that they’d much rather defer or an asset that they would prefer to leave to their children.

While the second group has limited options, they can protect the rest of their retirement assets and legacy money by purchasing hybrid long-term care, with a design that minimizes the tax burden and returns the majority of the inherited IRA tax-free to their beneficiaries.

The strategy behind this idea makes a few key assumptions that are necessary in order to implement it:

- A non-spouse (who isn’t a child, disabled/chronically ill, or less than 10 years younger than the deceased) is the beneficiary.

- The asset isn’t needed for retirement funding.

- The beneficiary would have a substantial tax liability if they liquidated the account.

- They don’t currently have LTC or their current LTC plan is underfunded.

Examples

There is availability nationally for this strategy. The simplest way to present utilizing an inherited IRA to fund a client’s long-term care needs is to use a turnkey product.

Currently, OneAmerica (A+ Rated) is the only carrier offering a turnkey solution. There is a workaround if you’d rather utilize a different company, which we’ll explore later in this article.

For the sake of this example, we are going to assume a 57 year-old couple in Colorado who recently inherited an IRA from one of their parents totaling 150k. Since the beneficiary is considered a non-eligible designated beneficiary, the parent was 87 when they passed away, RMDs are required and the entire account must be liquidated in 10 years.

Leverage

As with all of these products, the main concept is to reposition assets to create substantial leverage for the purposes of long-term care protection.

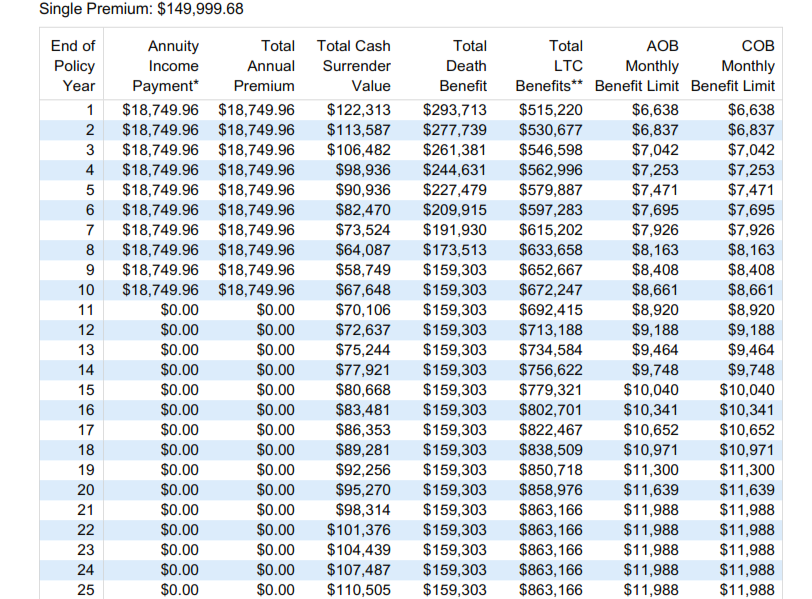

Below, you can see that by placing the inherited IRA into the hybrid LTC policy, these clients experience substantial protection immediately and it only becomes more substantial over time:

*You can download the complete illustration HERE

OneAmerica has three major advantages over the competition:

- They are the only carrier to make this process entirely turnkey (no action to complete the plan).

- They are one of only a few carriers in the LTC/Life hybrid space that allows joint insureds.

- They are the only hybrid LTC policy on the market offering lifetime LTC benefits.

NOTE: When on claim, BOTH insureds are eligible for the full monthly benefit. If the policy design has a limited benefit period, both the death benefit and the LTC continuation benefit will be reduced by 2x. If the benefit period is unlimited, then it will just reduce the death benefit by 2x.

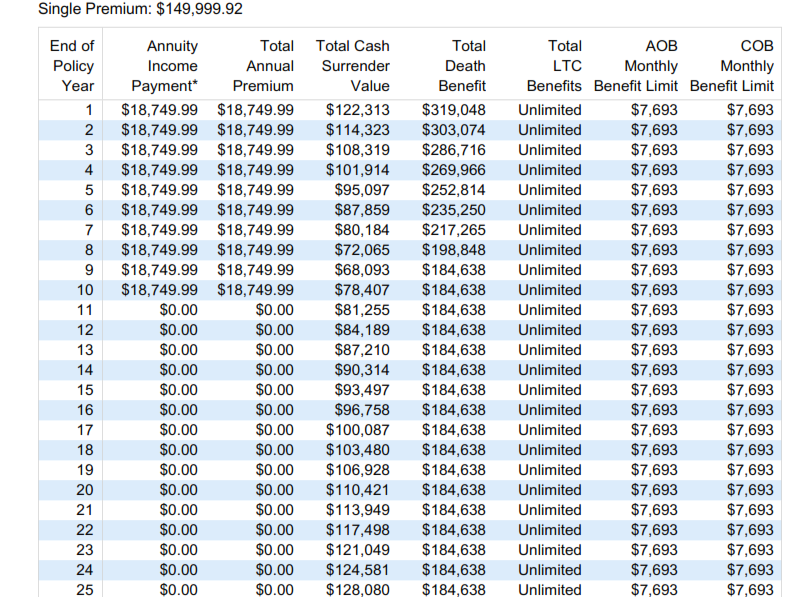

This illustration shows all three of these benefits.

*You can download the complete illustration HERE

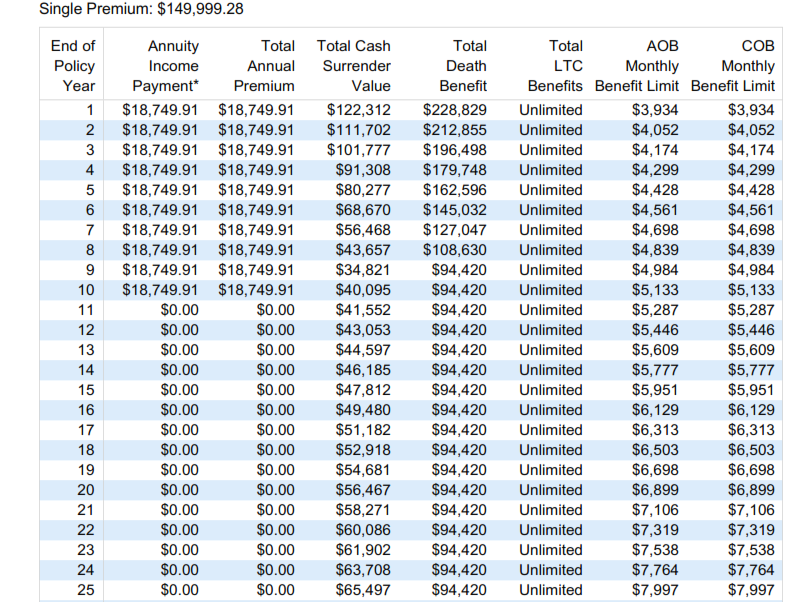

Here is how an inflation rider would affect the policy:

*You can download the complete illustration HERE

As you can see, the death benefit decreases as does the initial monthly benefit. The crossover point is roughly age 81 (when you would have been better off taking the inflation option) so an analysis is necessary to determine what design and riders are appropriate for each individual client.

Taxation

Because our hypothetical couple are still working, liquidating this inherited IRA will cause a tax liability of 50k (33% of 150k ). They are already being forced to take RMDs from this account, even though they don’t need the money.

Stretching the tax burden over the entire account makes the tax bite much more palatable, even though the account must be liquidated in 10 years.

Using a 10 pay annuity to fund the LTC policy, the tax burden is minimized AND the benefits, whether used for LTC or passed along as a death benefit, are 100% tax free.

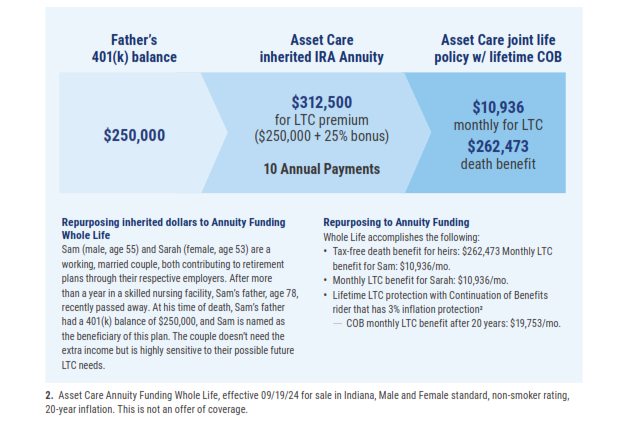

See the example below (which differs from the previous examples) on how the funding of this policy works:

As you can see above, there are a few moving parts to the policy. First, the IRA is sent via trustee to trustee transfer to the carrier. The carrier provides a 25% bonus to the money and then distributes the IRA over 10 years, satisfying RMDs and the liquidation requirement.

The distributions fund the hybrid life/LTC policy in a turnkey fashion, meaning that there is no responsibility by the agent or the client to fund the policy. Everything, the annual funding, the tax responsibility, and the accounting of both “pots” of money (the remaining IRA and the cash values/death benefit/LTC benefit) takes place within the policy’s ecosystem.

The tax liability only lies with the annual distribution each year. Once the account is depleted, the remaining benefits (most of the cash values and all of the death benefit and/or the long term care) are no longer taxable.

Underwriting

In previous articles we discussed the ease of utilizing LTC annuities and the flexibility of their underwriting.

For hybrid life/ltc, the underwriting is more stringent.

Having a death benefit that returns all or even more of the premiums paid introduces additional health questions, beyond those that are just likely to generate a long-term care claim.

That said, in many cases these products are still more forgiving than traditional LTC, with many of the products having relaxed underwriting in many categories.

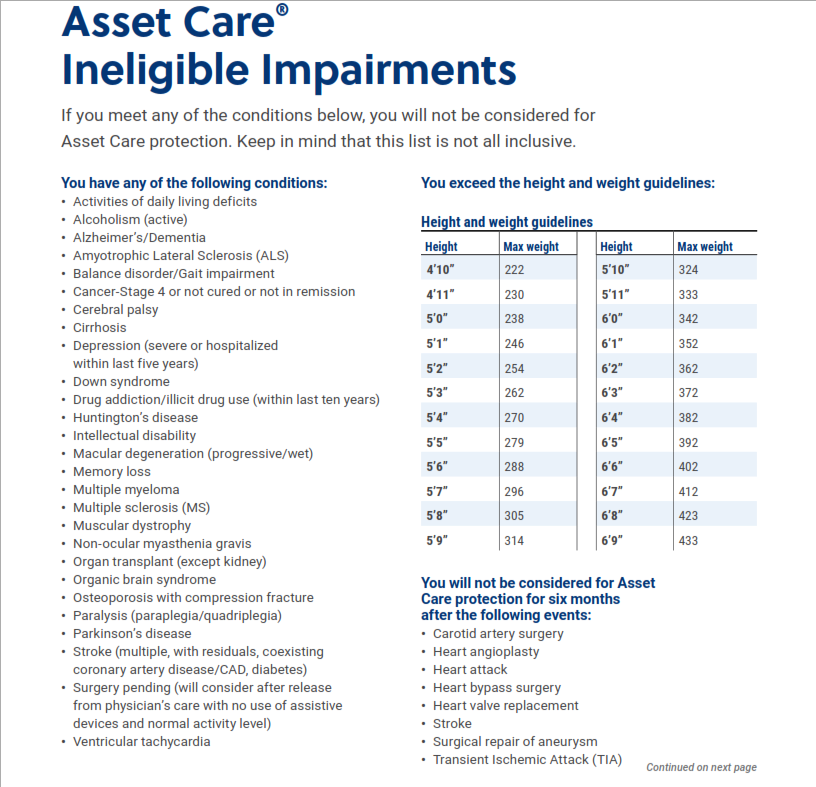

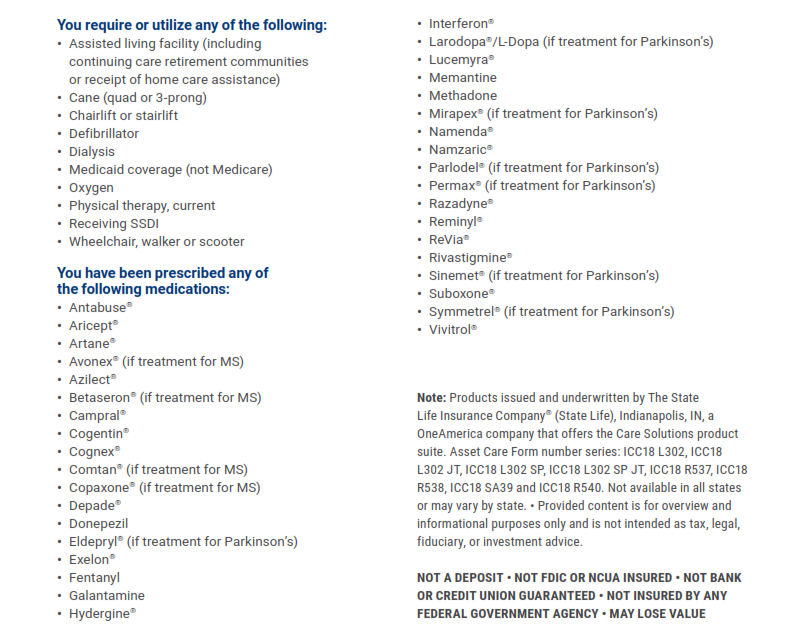

Below are the ineligible conditions on OneAmerica’s prescreen. Most carriers in this space have a similar sheet that we can utilize to get a reasonable estimate of approval.

OneAmerica is also one of the few carriers with table ratings so can be ideal for a couple where one spouse’s health is much less desirable than the other’s.

Extras

As mentioned previously, having joint benefits and lifetime LTC are big advantages for OneAmerica. In addition, having the entire process be turnkey is extremely attractive for both the client and the financial advisor/agent.

However, there are times when other products may make sense. For instance, a single individual can use products that offer much more leverage with complete indemnity.

In order to replicate what OneAmerica does internally, we design our own 10 pay SPIA (which generates the required RMD and liquidation) and use it to fund a 10 pay hybrid life/LTC policy.

The wrinkle is that the timing has to be set up properly so that the SPIA payment hits the client’s bank account just before the withdrawal is required for the LTC policy. It’s not complicated, but it is an extra step that can be complicated by changing banks, forgetting to authorize the withdrawal or send a check, etc.

Conclusion

OneAmerica not only has some of the highest ratings of carriers who offer these products but also has very competitive compensation.

The ability to unwind an inherited IRA and provide lifetime LTC benefits can be very attractive for some clients. Covering both spouses and having the backstop of a death benefit and cash values helps to mitigate one of the main objections to traditional LTC: use it or lose it.

Our charge as a wholesaler/IMO is to find products and concepts that benefit your clients and benefit your practice. Reposition unproductive or unneeded assets in a way that substantially improves your clients’ overall financial plans.

If you’d like to explore how these products can enhance your practice or are curious about any of the points outlined in this article, please contact us today.